Get paid on time

For small businesses, maintaining healthy cash flow is a critical aspect of survival and growth. One of the most common challenges these businesses face is the timely collection of payments from clients. Late payments can severely disrupt cash flow, leading to difficulties in covering operating expenses, paying employees, and investing in business growth. Sending timely payment reminders is an essential strategy to mitigate these challenges. However, the process of drafting and sending these reminders can be time-consuming and emotionally taxing, particularly when trying to strike the right balance between being firm and maintaining a positive client relationship.

Pain Points Small Businesses Face in Collecting Payments

Inconsistent Cash Flow: Late payments can cause significant cash flow inconsistencies, making it difficult for small businesses to manage day-to-day expenses. This unpredictability can prevent businesses from planning effectively for the future, limiting their ability to invest in growth opportunities, purchase inventory, or cover unexpected costs.

Strained Client Relationships: Following up on overdue invoices can be awkward and may strain relationships with clients. Many small business owners fear that sending frequent reminders will damage their rapport with clients, leading to potential loss of future business. This can result in delayed or non-payment as the business hesitates to push too hard.

Time-Consuming Processes: Manually tracking and following up on unpaid invoices can be incredibly time-consuming, especially for businesses with limited resources. The time spent on chasing payments is time not spent on core business activities, such as sales, marketing, or customer service.

Emotional Toll: Small business owners often feel uncomfortable or anxious about asking for money, especially when dealing with clients who may be going through tough times themselves. This emotional toll can lead to procrastination in sending reminders, further exacerbating cash flow issues.

How popUP Email Automation Helps

popUP Email Automation streamlines the process of sending payment reminders, alleviating the burden on small business owners. By automating these reminders, popUP ensures that every client receives a consistent, professional, and timely notification about their outstanding invoices. This automation reduces the emotional stress associated with asking for payment and frees up valuable time that can be redirected toward growing the business.

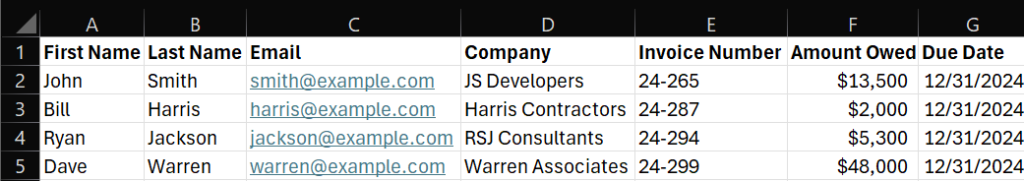

Example Excel Spreadsheet

Here is an example of what your excel spreadsheet might look like containing a list of clients, their unpaid invoices, the invoice due dates and the amount owed.

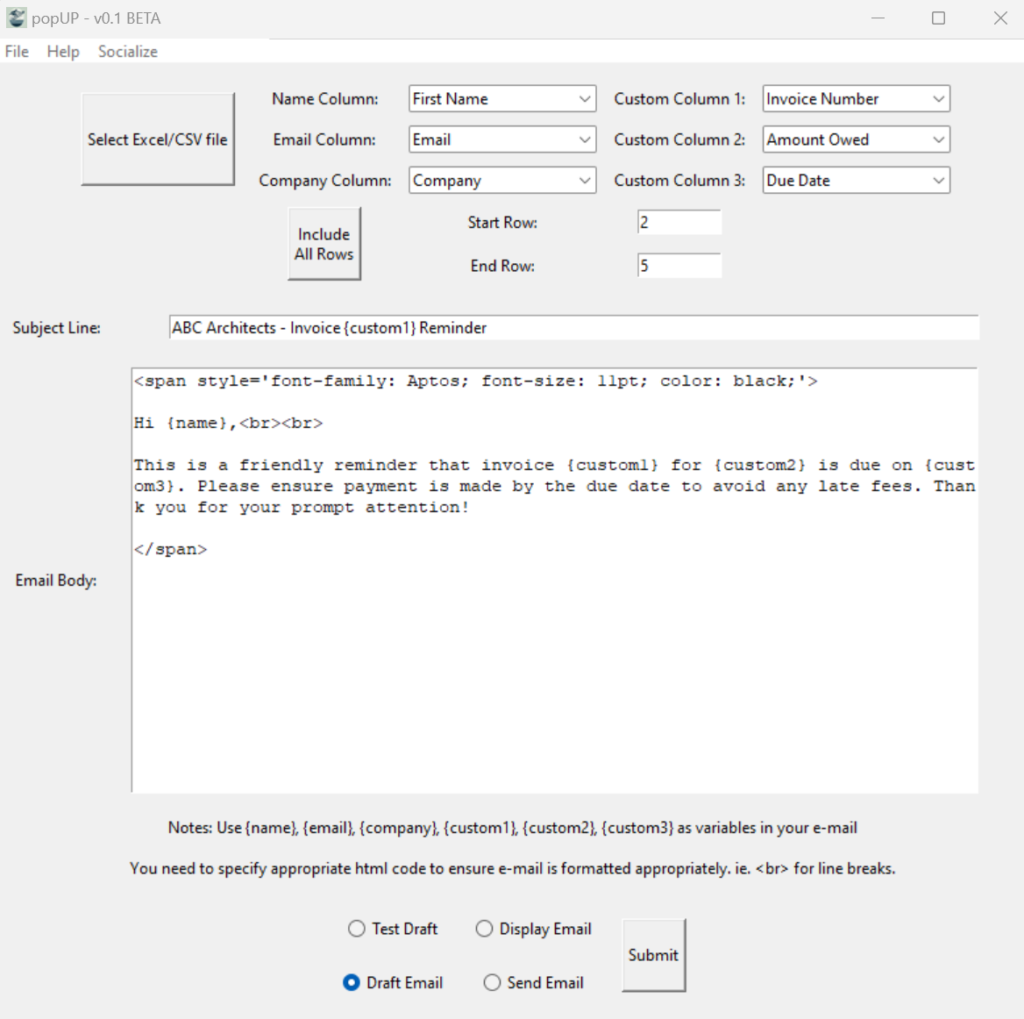

Variables Used

{name}: Client’s name- {company}: Client’s Company

{custom1}: Invoice number{custom2}: Amount Owed{custom3}: Due Date

Example Email Script

Subject: ABC Architects – Invoice {custom1} Reminder

Hi {name},

This is a friendly reminder that invoice {custom1} for {custom2} is due on {custom3}. Please ensure payment is made by the due date to avoid any late fees. Thank you for your prompt attention!

Invoicing Email Automation

Monitor incoming payments and send follow-up emails as necessary. Experiment with different variables, maybe it makes sense to mention the number of days an invoice is overdue or even how much is owed in late payments. popUP Email Automation allows you to send these reminders automatically, reducing the time spent chasing payments and ensuring a consistent approach.